FedEx Freight Separation Forces Enterprise TMS Rewrites: Integration Architecture Changes Every Team Must Plan For

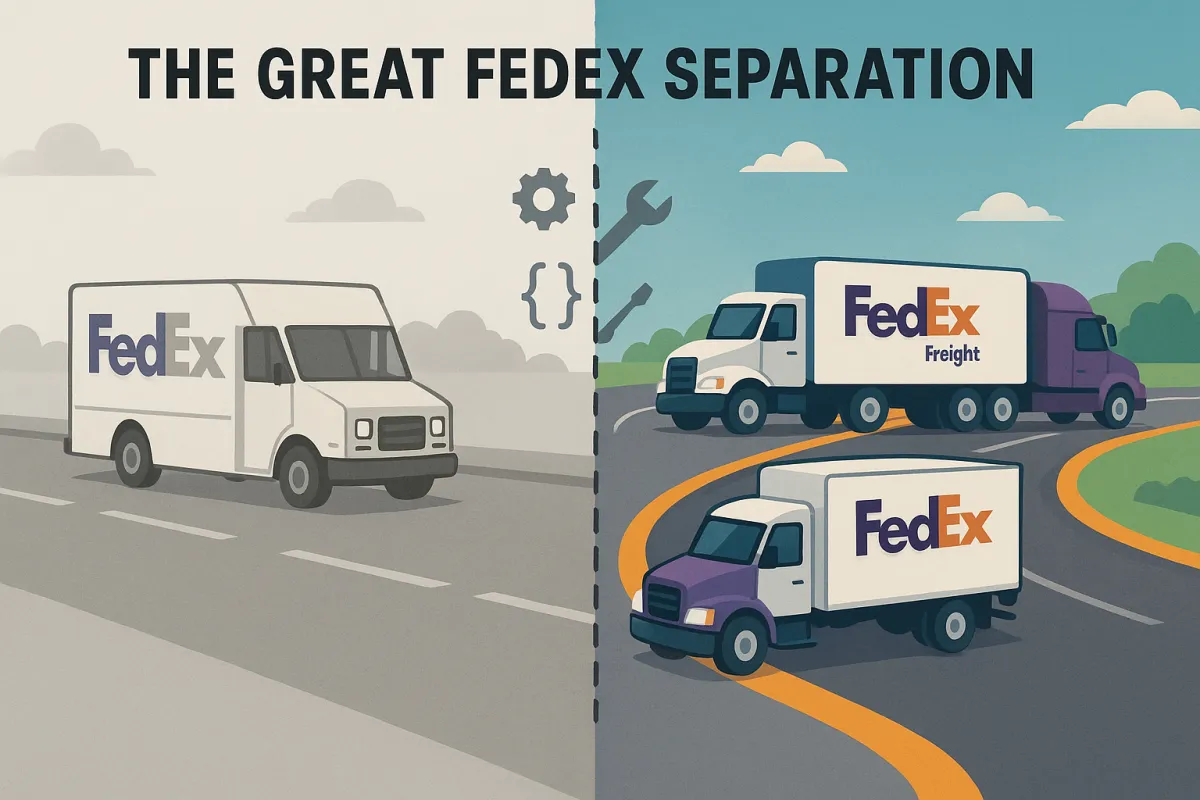

FedEx Freight currently handles roughly 90,000 shipments per day, operates more than 350 service centers across North America, and generates nearly $9 billion in annual revenue, so when this division becomes an independent company by June 2026, the integration challenges for enterprise TMS platforms won't be minor.

Most integration engineers know the pain of API changes. But this FedEx separation creates something much harder: splitting what appears to your TMS as a single carrier into two distinct entities with separate endpoints, authentication, and commercial agreements.

The Integration Reality Behind FedEx's $9.4B Freight Separation

Here's what your system sees today: one authentication flow, one set of contracts, one unified discount structure that lets LTL spending fuel lower last-mile delivery rates. After the spinoff, you're managing two separate companies that happen to share similar branding.

FedEx is investing $600 million in IT infrastructure for the spinoff, which tells you something about the technical complexity. They're not just changing letterheads. Every API endpoint, every authentication flow, every data structure needs to be rebuilt for independent operation.

The timing pressures are real. FedEx is already pushing for reworked agreements that move shippers from bundled contracts to separate parcel and LTL arrangements, targeting contracts with "a pretty significant amount of LTL volume". They're not waiting until 2026 to start this process.

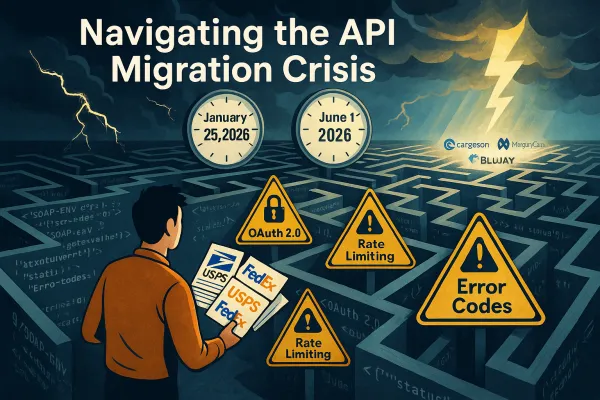

For platforms like Cargoson, nShift, or Manhattan Associates, this means immediate architecture planning. You can't just add another carrier to your existing multi-carrier framework - you need to handle what customers perceive as the same brand appearing twice in rate comparisons, potentially with conflicting service levels and pricing.

Bundled Contract API Challenges

The technical debt here runs deeper than most carrier changes. Earned discounts are based on gross revenue, with both LTL and parcel spend contributing toward that figure in bundled arrangements. Your TMS rate calculation engine currently treats FedEx as a unified entity when computing these discounts.

After separation, that single discount calculation splits into two independent systems. Your rate shopping algorithms need to understand that what used to be cross-service volume incentives now become separate negotiations with different entities. Customer rate tables that reference FedEx contract terms suddenly need disambiguation between parcel and freight operations.

The authentication complexity multiplies too. Instead of one set of API credentials, you're managing separate authentication for two companies that customers still think of as "FedEx." Your credential management system needs to handle this gracefully without confusing operations teams.

Technical Architecture Changes Integration Teams Face

The separation creates immediate dual-system requirements. The spun-off LTL will continue commercial collaboration with FedEx to ensure a seamless transition for customers, but that's commercial policy, not technical reality. Your APIs need to route to completely different systems.

Rate shopping becomes particularly complex. Currently, your TMS can compare a FedEx Ground shipment against FedEx Freight LTL as part of mode optimization. Post-separation, you're comparing two different companies with potentially different response times, error handling, and data formats.

The contract data model restructuring hits every TMS platform. Platforms like MercuryGate, Descartes, or Cargoson need to redesign how they store and reference carrier agreements. A single "FedEx" contract entry becomes two separate entities with independent commercial terms.

Version control becomes critical. During the 18-month transition window, you're potentially managing both the legacy unified system and the new separated systems simultaneously. Your API version management needs to handle this gracefully without breaking existing integrations.

Authentication and Account Management Splits

Most enterprise TMS platforms use OAuth or similar token-based authentication with carriers. The FedEx separation means every existing token, every stored credential, every API key needs evaluation for which entity it now represents.

Your authentication flow logic needs updates too. Instead of a single login flow to "FedEx," your integration layer needs to distinguish between parcel and freight authentication, potentially with different sandboxes, different approval processes, and different credential rotation schedules.

The customer account mapping gets messy. If your TMS stores a single "FedEx account number" for a shipper, that now needs to map to potentially two different account structures. Customer data migration becomes a required project, not an optional cleanup.

Contract Management System Overhauls Required

FedEx made a pivot "about four or five years ago, recognizing that when we are competing in a fragmented market, we had to negotiate the freight business separately". But many TMS implementations still reflect the older bundled approach in their data models.

Your contract management module needs immediate attention. Every FedEx contract needs review to determine which services transfer to which entity. Rate tables that reference unified FedEx discounts need restructuring to handle separate discount calculations.

The billing reconciliation changes compound the problem. Instead of one invoice source, you're potentially receiving separate invoices for what customers think of as a single shipping decision. Your invoice matching logic needs updates to handle this split.

Platforms designed for this complexity - like Cargoson, which focuses on multi-carrier integration challenges - have advantages here. But even purpose-built systems need architectural changes to handle a major carrier splitting mid-contract.

Rate Calculation Engine Impacts

The discount matrix calculations need complete overhauls. "The LTL industry often refers to FedEx Freight as the Cadillac of all LTL providers, but you're paying for it as well", which means your rate comparison logic needs to account for potentially different pricing strategies from the two separated entities.

Volume tier calculations become particularly complex. If a customer currently qualifies for better rates based on combined parcel and LTL volume, that calculation splits. Your rate engine needs logic to handle the loss of cross-service volume benefits while potentially adding new volume tiers from the independent freight company.

Rate validity periods might change too. Currently, FedEx provides unified rate updates. Post-separation, you're synchronizing rate updates from two independent sources with potentially different update schedules and effective dates.

Timeline and Migration Planning Considerations

The 18-month window sounds generous until you consider the testing requirements. You need to validate that your TMS can handle parallel operations during cutover, rollback capabilities if integration fails, and customer communication about service changes they didn't request.

Separation costs already hit $9 million in Q1 for FedEx itself. Integration teams should budget for similar infrastructure costs - dual system testing, parallel API connections, and extensive UAT across all affected workflows.

Peak season timing adds pressure. The June 2026 cutover happens right before peak shipping season prep. Your testing cycles need completion well before that, meaning real integration work starts immediately.

Multi-carrier platforms like Cargoson enable rapid alternative carrier onboarding, which becomes valuable insurance during this transition. If the separation causes service disruptions, you need backup carriers ready.

Production Cutover Risks

The separation creates unprecedented cutover complexity. You're not adding a carrier - you're splitting an existing one while maintaining service continuity. Your cutover plan needs to handle partial failures, where parcel operations succeed but freight operations fail, or vice versa.

Rollback planning becomes critical but complex. How do you roll back to a unified system that no longer exists? Your contingency planning needs alternative carrier capacity ready, not just technical rollback procedures.

Customer communication adds another layer. Shippers didn't choose this separation, but they need to understand why their TMS now shows two entries for what they consider one carrier. Your user interface needs clear differentiation without causing confusion.

Alternative Carrier Integration Opportunities

Parcel-heavy customers with a low number of freight shipments are top candidates to explore alternative LTL options. The forced separation gives shippers a natural opportunity to reconsider their carrier mix entirely.

Competitors like Old Dominion, XPO, and regional carriers may respond with network or pricing adjustments. Integration teams should prepare for rapid carrier onboarding as these alternatives become more attractive.

API-first platforms have advantages here. When Cargoson or similar platforms can add new carriers quickly, the FedEx separation becomes less disruptive. You're not locked into a two-provider solution just because that's how FedEx chose to reorganize.

The market timing works in shippers' favor. FedEx's decision could trigger a ripple effect across the LTL landscape, with investors modeling standalone valuations that could influence rate strategies. More competitive pressure typically means better shipper rates.

Multi-Carrier Strategy Advantages

The separation reinforces why carrier diversity matters. Shippers with robust multi-carrier strategies handle this transition better than those heavily dependent on FedEx's bundled services.

Your rate shopping algorithms benefit from more carriers. Instead of optimizing between FedEx parcel and FedEx freight, you can optimize across multiple parcel providers and multiple LTL providers, potentially finding better service combinations.

Risk reduction becomes measurable. When major carriers undergo structural changes like this separation, having alternatives already integrated in your TMS means business continuity rather than emergency carrier onboarding.

Implementation Recommendations for Integration Teams

Start your dual-authentication setup immediately. The 18-month timeline seems long, but testing requirements are extensive. You need both systems working in parallel before cutover, not just basic connectivity.

Build contract management flexibility now. Even if you're not affected by the initial bundled contract changes, your data models need to support more complex carrier relationships. Future carrier consolidations or separations become easier with flexible architecture.

Test your rate calculation engines with separated data. Create test scenarios where volume that currently qualifies for bundled discounts gets split between two entities. Your algorithms need to handle discount loss gracefully.

Plan for API endpoint changes early. FedEx's $600 million IT investment suggests comprehensive system rebuilds, not just rebranding. Assume endpoint changes, not just authentication changes.

Consider platforms like Cargoson that specialize in complex multi-carrier scenarios. If you're building integration capabilities from scratch, purpose-built tools handle these transitions more smoothly than custom integrations.

The FedEx Freight separation isn't just a business reorganization - it's a forced migration project for every TMS platform serving affected customers. The 18-month timeline starts now.